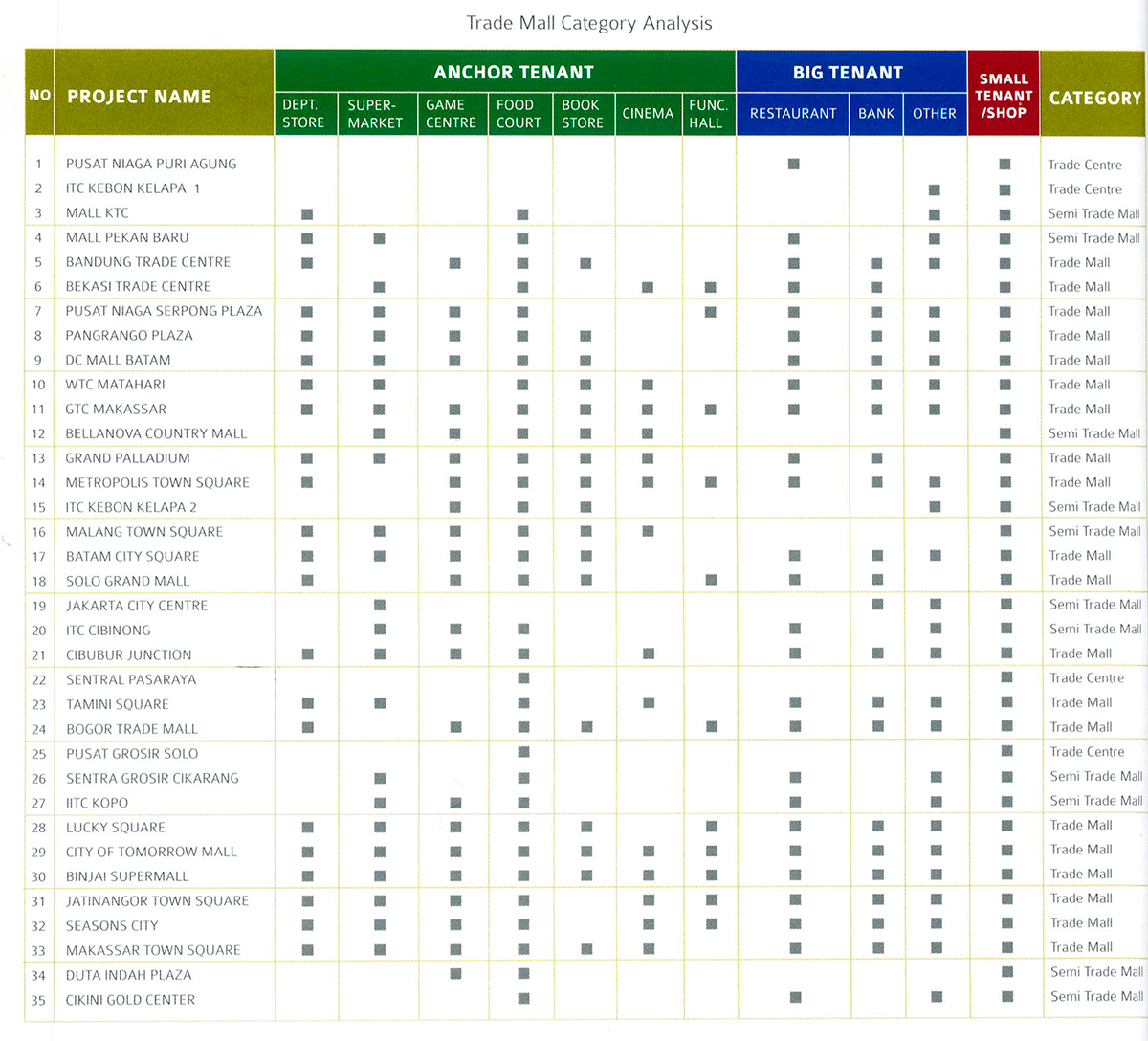

Determining trade mall category is heavily dependent on the condition of the surrounding areas, project scope, capacity and the extent of the project.

After determining what kind of tenants are going to be developed in the project, the next step will be to arrange the composition of each tenant. In arranging compositions, all calculation aspects will be linked to project cost needed, and expected revenue, to reach certain profitability point expected in a certain period of time. In this trade mall concept, the composition and placement of anchor tenants, big tenants as well as small tenants/shops will very much affect profitability percentage. In the designing process, we must find a certain collaboration of the composition which will provide maximum profit, in terms of financial, architectural and social.

Other than the internal factor of the trade mall itself, some other variables must also be considered in trade mall design, such as starting capital (land, construction, permit costs, mechanical electrical, landscape as well as periodic capitals such as maintenance, rent cost, etc). These variables are very much linked and eventually will contribute to a well planned design which will prove to be very useful to the developer.

In the previous section, we know that based on the ownership status, the tenant is divided into 2 categories. One of them is lease, consists of anchor tenant and big tenant, which are pronounced as rentable areas. This area will provide periodic revenue to the developer according to the contracts made with the tenant owner.

The second category is strata title, which consists of a small tenant/shop, as a saleable area.

There are 2 main points in designing these tenants, that is the placement/positioning and amount of the tenants which eventually will create an efficient state, where anchor tenant, big tenant, and shops form a pulling force towards the customers and will lead to creating balance for each type of tenant.

The percentage calculation of tenant efficiency and composition is divided into 2 types, namely overall efficiency percentage and shop efficiency percentage. The overall efficiency percentage is a comparison between saleable and rentable areas with the overall gross width of the whole building. Saleable and rentable areas are the net width of areas to be sold (exclude corridor, stair, service area, and others). This calculation will provide an overall picture on the revenue in a certain period of time.

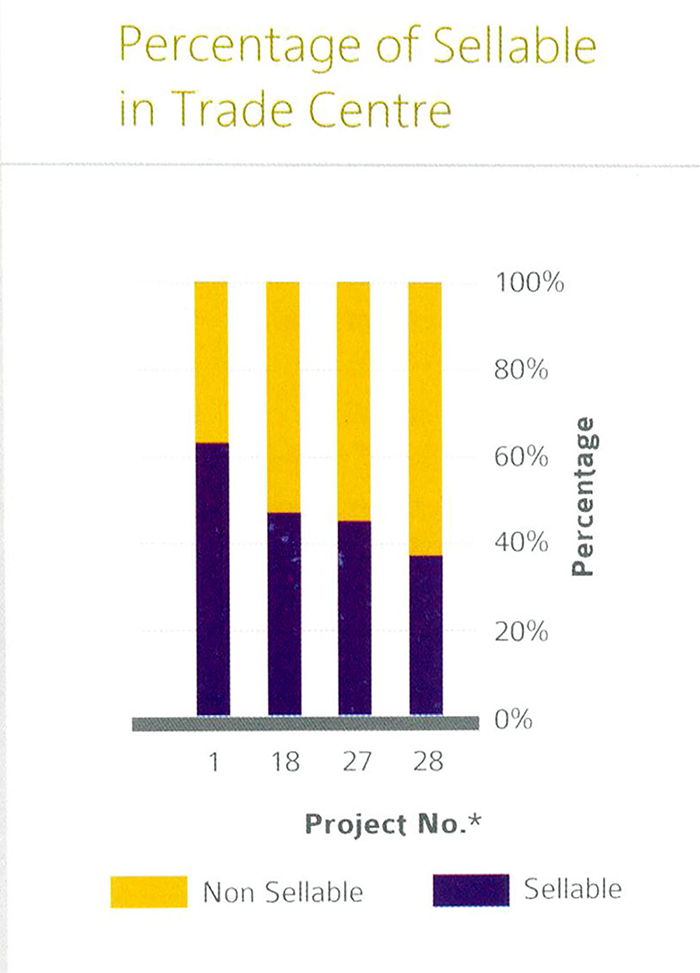

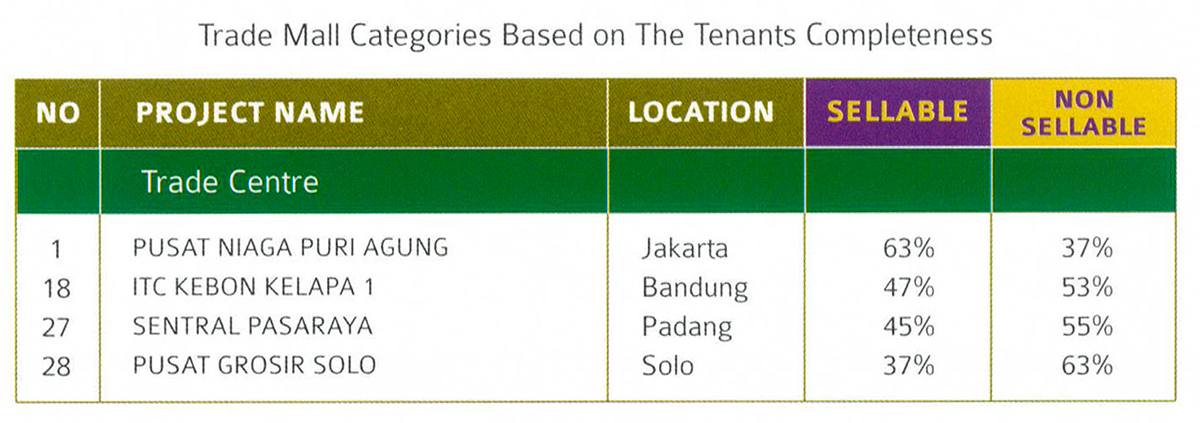

“A Trade Mall without an anchor tenant/trade center will have a smaller rentable and saleable percentage, compared to a complete Trade Mall.”

The second calculation, shop efficiency percentage, is a comparison of saleable area (net width of the shop) with gross width of the whole building minus rentable area (anchor tenant and big tenant area). This calculation will provide the overall picture on the potential saleable area effectiveness from the overall width of a trade mall, which will act as an initial revenue for capital to build the projects Therefore, the composition of saleable area must be managed to the maximum and to the most effective extent, in order to gain maximum profit.

A trade mall without anchor tenant/ trade center will have smaller rentable and sellable percentage compared to that in a complete trade mall. It is because in trade centers, the tenant composition is dominated by shops, which directly produce corridors for visitors’ circulations. These corridors between shops will use up sellable areas and eventually cause the decreasing percentage of saleable areas in the building. Nevertheless, this thing needs to be executed by some projects due to the need of large starting capital, causing developers to maximize selling of strata title shops.

While in a trade mall with lots of anchor tenants will have higher saleable and rentable percentages. This is due to the circulation area within the anchor and big tenant is determined by the tenant owner and calculated as the rented area. The weakness of this category is, the anchor and big tenant, not involved while starting the capital because these tenants are leased after the project is completed.

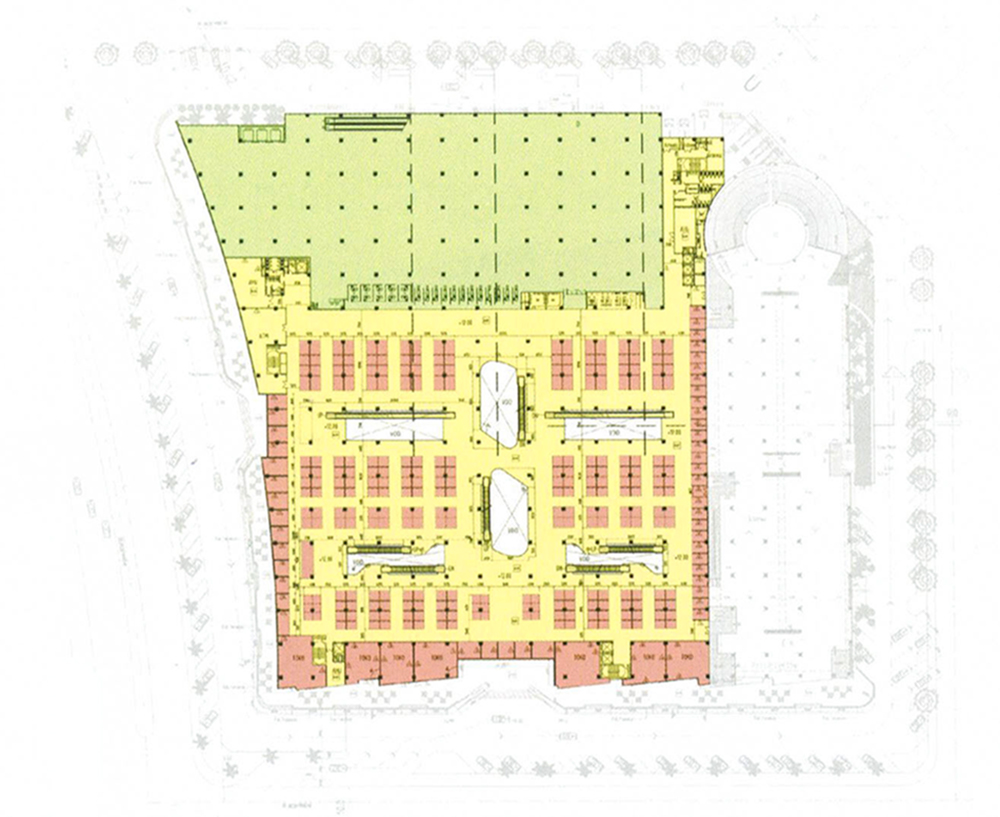

In managing the amount and shop arrangement, each project has been going through evolution from time to time. Through experience and several trials and errors, things that were previously neglected, up to the details in planning have now been exposed. For instance, in the matter of the existence of a second corridor in a trademall, which is a development from the main corridor similar to mall concept, the second corridor is the branch out of the main corridor.

Anchor and big tenant concepts act as a magnet to visitors, and smaller shops are already divided based on the second corridor. This proved to be problematic, whereas the length of the array of shops has a certain limit. If the line is too long, it would make the shops in the middle area suffer lack of visitors, therefore will become bankrupt, while the other shops in the hook area are crowded with visitors. The initial 5 lines of shops has proven to fail in terms attracting customers in the middle area, therefore the line was made to be 4 shops with eliminating formations where there are shops in the middle.

However as time progresses, the form of a trade mall with a second corridor is avoided. It is found that maximum profit for shop owners will only be achieved if the shops are square shaped and divided into 4 equal areas, so that the shop has hook side and the second corridor principles can be eliminated. With both hook sides, the shop is more open, hence attracting more visitors and profitable for the owner. The elimination of the second corridor principle also removes partitions between corridors, which makes the inside of the building feel wider and more loose thus creating a comfortable surroundings.

By calculating the efficiency of rentable and saleable areas, combining them well, the expected profitability percentage can be easier to reach within the agreed timeframe.

“Other than the internal factor of the trade mall itself, some other variables must also be considered in Trade Mall design, such as starting capital (land, construction, permit costs, mechanical electrical, landscape) and periodic capital (maintenance, rent cost, etc).”